News Center Unit of the University of Baghdad / Institute media

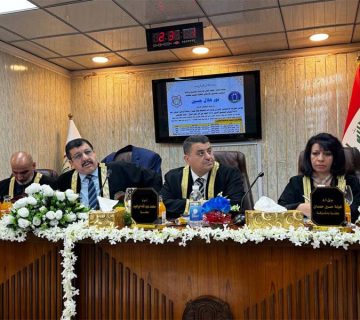

The Department of Financial Studies at the Higher Institute of Accounting and Financial Studies for Postgraduate Studies at the University of Baghdad discussed the research tagged (Tax Examiner Adequacy and its Effect on Detecting Profits’ Artificial Manipulation”- An Applied Research in the General Tax Authority) for the student Nada Aziz Hussein to obtain a higher diploma equivalent to a master’s degree in taxes and grants its holder All rights and privileges of a master’s degree.

The study aimed to measure the effect between the independent variable “Tax Examiner Adequacy” and its dimensions (scientific and practical (expertise) qualifications, training, developing, neutrality, independency and professional ethics) and between dependable variable “Detecting Profits’ Artificial Manipulation” and the degree to which the dimensions are organized according to its importance and priority..

The study reached to raise the efficiency of the tax examiner by paying attention to continuous education and training programs, working on rehabilitating the existing elements, following up on scientific seminars and attending conferences in the accounting field, and the tax administration not exercising pressure on the tax examiner in order to reduce or increase the tax imposed on taxpayers in order to maintain neutrality and independence Tax examiner to do his job better.